Our Services

At Kin Financial we don’t do transactional mortgages and loan processing. We help you start and build out your roadmap to a prosperous property portfolio. Here’s how…

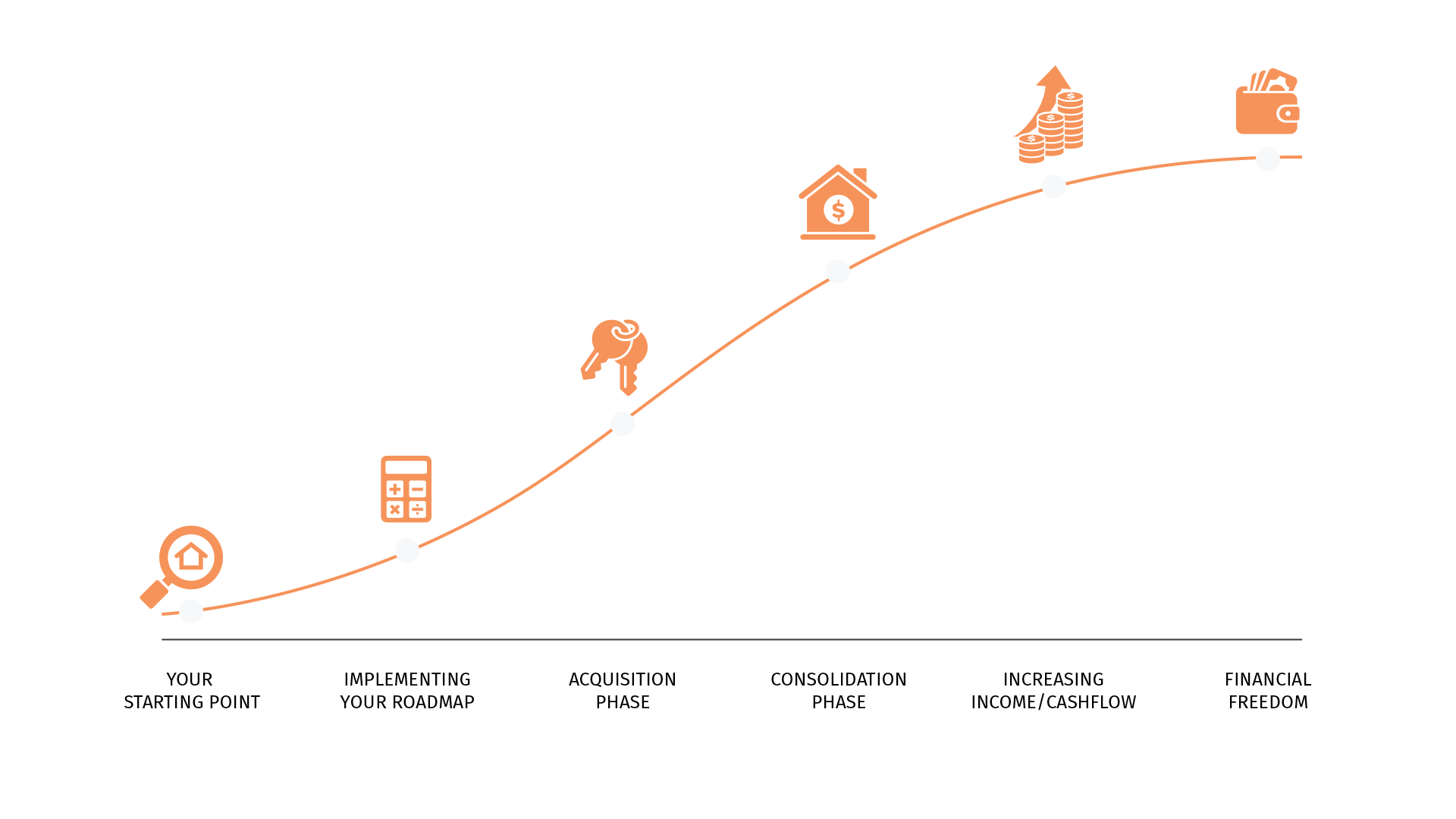

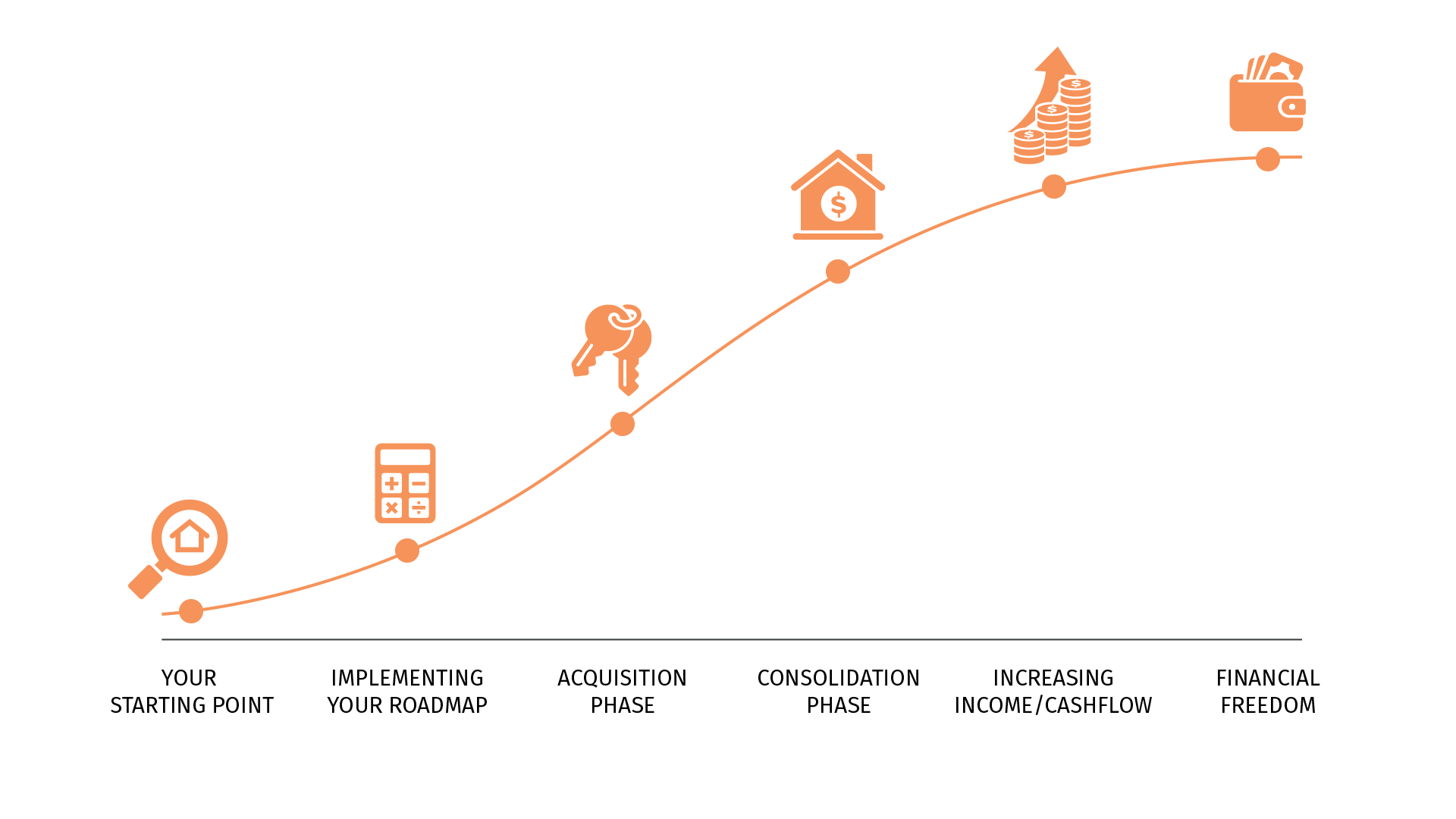

THE KIN FINANCIAL investment journey

(For more info, hover over the toggle icon.)

Your Starting Point

Implementing your Roadmap

Acquisition Phase

Consolidation Phase

Increasing Income / Cashflow

Financial Freedom

Your Starting Point

Every journey starts with acknowledging where you are right now. At Kin Financial, we take the time to learn about your unique circumstances and align our objectives with yours, ensuring clarity in building your property portfolio.

Implementing your Roadmap

With our customised approach at Kin Financial, we empower you to make a substantial leap forward in your portfolio. Our strategic financial restructuring enables you to enhance your cash flow, unlocking the potential for additional funds that can be reinvested to fuel the growth of your property holdings.

Acquisition phase

In the acquisition phase, we work together to help you build your property portfolio from the ground up. With our expertise in the Australian property market, we guide you through the process of selecting suitable investment properties, negotiating favorable terms, and securing financing options that align with your goals. Whether you’re a first-time investor or expanding your existing portfolio, we provide the knowledge and support to ensure a successful acquisition phase.

Consolidation phase

Once you have established a solid foundation with your initial property acquisitions, it’s time to enter the consolidation phase. During this stage, our team at Kin Financial helps you optimise your portfolio by evaluating your current holdings, identifying opportunities for growth, and implementing strategies to maximise your returns. We focus on streamlining your portfolio, enhancing cash flow, and leveraging equity to unlock new investment possibilities. Our goal is to assist you in creating a robust and balanced property portfolio that aligns with your long-term wealth-building objectives.

Increasing income/cashflow

As your income from your investment properties grows, freedom becomes a reality. The cash flow generated by your portfolio can potentially match or exceed your salary, giving you the freedom to choose how you want to focus your time and energy – whether it’s on your daily job, your investments, or anything in between. This milestone marks the power of choice.

Financial Freedom

Financial freedom is the ultimate realisation of your property portfolio’s cash flow and equity potential. It grants you the autonomy to live life on your own terms, empowering you to make a positive impact and contribute to the causes you care about. At Kin Financial, we are deeply passionate about helping you achieve this freedom, and it’s the driving force behind everything we do.